On payment of Contractor, Publisher, Ad-Service Provider etc. above Rs. 20000/- in the financial year, then the TDS is must be deducted under section 94J, 94C as well as TDS on Salary must be deducted by employer from salaried employee u/s. 192. After deducting the tax the responsibility of Tax Deductor is that to submit Income Tax Return Quarterly in 26Q or 24Q in electronic Form (e-TDS Return). Now with the help of this data uploaded by you, Form No. 16A can be generated from TIN-NSDL site. It has been made compulsory by the Income Tax Department for all deductors to issue Form 16A generated through TIN-NSDL site. A Circular in this regard has been issued by the Department bearing no. 1/2012 dated 09/04/2012. It has been mandatory from 01/04/2012. Earlier in the Financial Year 2011-12 it was mandatory for Companies and Banks to issue Form 16A form TIN-NSDL site to their deductors from whom payments they have deducted TAX. So from now onward everyone should know the process ".

How to Download Form 16A from the TIN-NSDL site?

First of all you have to register your TAN at the TIN-NSDL site if it is not already registered. After making registration Log in to your account and follow the below procedure :

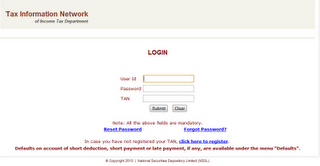

Login at tin-nsdl.com to your TAN Account as shown below-

On the Next screen it will ask the Login Details like as User ID, Password and TAN.

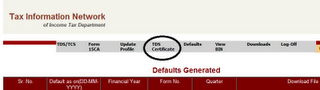

You can request for for Form 16 or Form 16A as per your requirement from the TDS Certificate button as shown in the below picture.

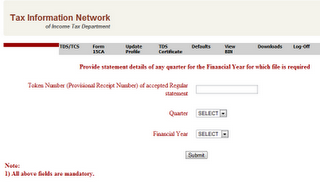

Some Details will be required Like as Token Provisional Receipt Number (PRN), QTR-1,QTR-2,QTR-3 or QTR-4 (as applicable), Financial Year. After entering these details click on the submit Button.

Some Details will be required Like as Token Provisional Receipt Number (PRN), QTR-1,QTR-2,QTR-3 or QTR-4 (as applicable), Financial Year. After entering these details click on the submit Button.  After entereing these details the next screen will ask the details as given in the picture below:

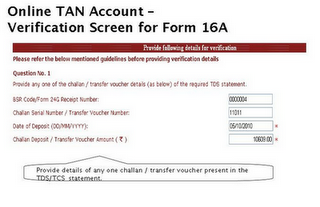

After entereing these details the next screen will ask the details as given in the picture below:And the second question as below

The next screen will show you to Download the Required Form 16 or Form 16A

The next screen will show you to Download the Required Form 16 or Form 16A Your request has been registered against Ref. No. ......... Form 16/Form 16A will be emailed to your registered e-mail ID within 48 hours.

Your request has been registered against Ref. No. ......... Form 16/Form 16A will be emailed to your registered e-mail ID within 48 hours.

0 comments:

Post a Comment